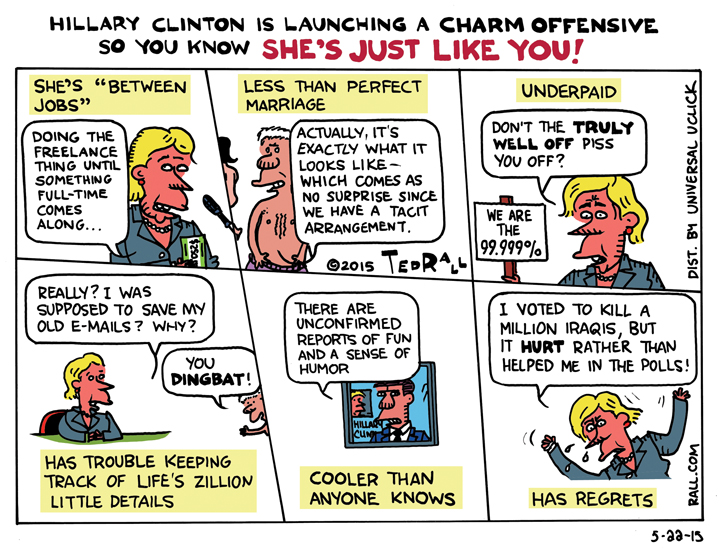

Acknowledging that she isn’t viewed as likeable enough, Hillary Clinton’s campaign is launching a charm offensive to convince Americans that she is a regular Jane Sixpack, just like us.

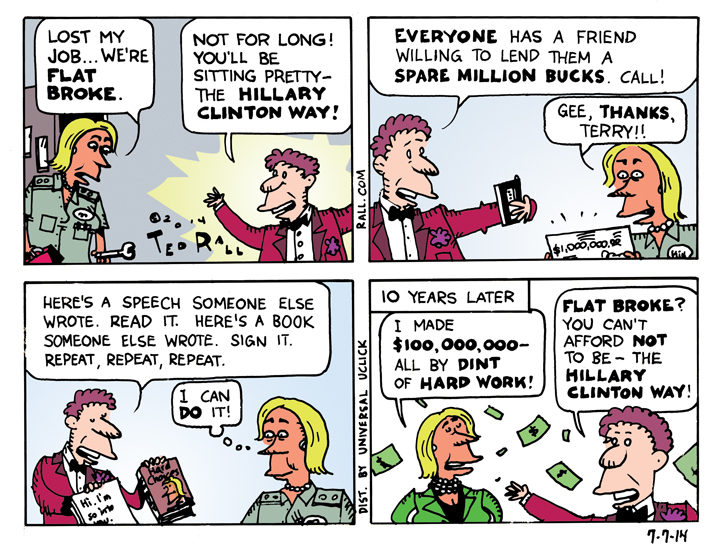

Flat Broke? Try the Hillary Clinton Way!

Hillary Clinton says she and her husband Bill were “flat broke” when they left the White House in 2001. But not everyone who is “flat broke” has a friend willing to lend them $1.2 million (Terry MacAuliffe) to buy a house. Then she claimed Americans don’t resent the $100,000,000 she and Bill earned through “the dint of hard work.” What hard work? Is Hill the new Mitt?

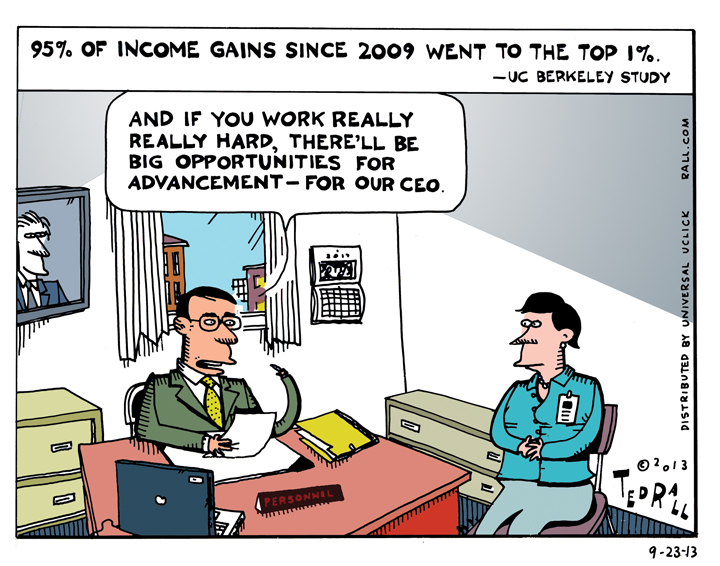

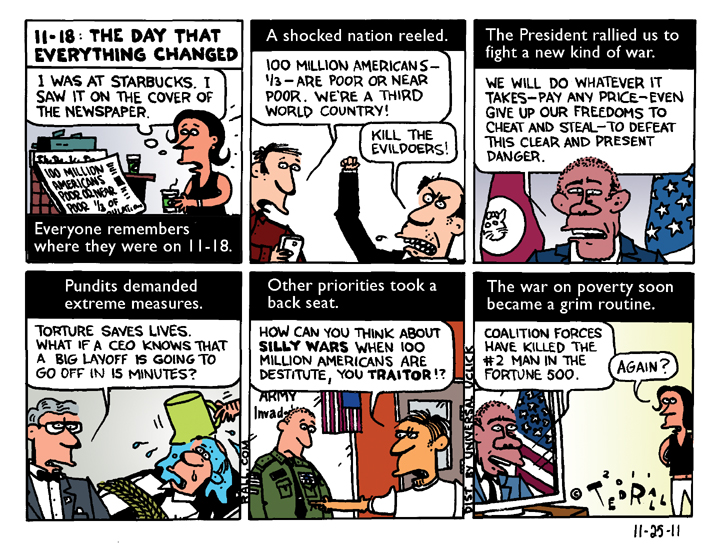

Big Raises – for the CEO

According to a study by UC Berkeley, 95% of income gains since 2009 went to the top 1%. Which makes one wonder: where is the incentive for the 99% to bust their asses working for the man?

SYNDICATED COLUMN: Yes, I Can

Straight Talk on Balancing the Budget

The federal budget deficit is like the weather. Everybody talks about it; except for Bill Clinton, no one ever does anything about it.

President Obama’s bipartisan Fiscal Debt Commission has released a draft report that starts out with a big problem: even talking about reducing spending is insane when you’re in the midst of a Depression. The real unemployment is over 20 percent. Creating jobs ought to be the feds’ top—perhaps sole—priority.

Let the insanity commence.

Triumphant Republicans say they want to balance the budget. So does Obama. Are they serious? Of course not.

Still, theoretical budget-balancing exercises help enlighten us about where our taxdollars really go. So let’s roll up our sleeves and start some back-of-the-envelope slashing.

The 2010 federal budget shows $3.6 trillion in spending and $2.4 trillion in revenues. Net deficit: $1.2 trillion. It’s a doozy, too. It nearly 13 percent of GDP. It’s the highest since 1943, during World War II.

The goal, then, is to close a $1.2 trillion budget gap. Can we find at least $1.2 trillion in budget cuts? News flash: getting rid of the National Endowment for the Arts ($161 million in 2010, or about 0.01 percent of the deficit), ain’t gonna do the trick.

Any serious budget cutter has to start with defense. The reason is simple: it accounts for 54 percent of discretionary (i.e., optional) federal spending. It’s the biggest piece of the pie by far.

(Mainstream news reports usually state that defense accounts for 20 percent of federal outlays. But they’re fudging the facts in order to pretty up the military-industrial complex. For example, they include budget items like Social Security that no one can do anything about—they’re in a trust fund.)

Of that 54 percent, 18 percent is debt service on old wars. There’s nothing we can do about that—though that number should probably give us pause the next time a president wants to invade Panama or Grenada.

Anyway, that leaves 36 percent, or $1.3 trillion to play with. $200 billion a year goes to Afghanistan and Iraq.

Let’s pull out. We’re losing anyway.

New Deficit: $1.0 trillion.

In 2007 Chalmers Johnson wrote a book about the staggering costs of American imperialism. “The worldwide total of U.S. military personnel in 2005, including those based domestically, was 1,840,062 supported by an additional 473,306 Defense Department civil service employees and 203,328 local hires,” he wrote. “Its overseas bases, according to the Pentagon, contained 32,327 barracks, hangars, hospitals, and other buildings, which it owns, and 16,527 more that it leased. The size of these holdings was recorded in the inventory as covering 687,347 acres overseas and 29,819,492 acres worldwide, making the Pentagon easily one of the world’s largest landlords.”

We’re broke. It’s time to bring those 2.3 million men and women home. At an average cost of $140,000 per employee—crazy but true—we could save $322 billion annually.

New Deficit: $676 billion.

After Defense, the other big costs are Social Security, Medicare and Medicaid.

The obvious place to start slashing is wealthy recipients. Why should Bill Gates, worth $58 billion, get Social Security or Medicare benefits? Dean Baker sums up the traditional liberal argument in favor of giving tax money to people who don’t need it: “Social Security enjoys enormous bipartisan support because all workers pay into it and expect to benefit from it in retirement. Taking away the benefits that better-off workers earned would undoubtedly undermine their support for the program. This could set up a situation in which the program could be more easily attacked in the future.”

Yeah, well, whatever. We. Are. Broke. “Means testing”—for example, eliminating benefits for the approximately one percent of families over age 65 who earn over $100,000 a year—could save $150 billion a year.

New deficit: $526 billion.

Now let’s talk about the other side of the equation: income. How can the U.S. government scare up some extra cash?

Allowing the Bush tax cuts for the richest three percent of Americans to expire on schedule would bring in $70 billion a year. Seems like a no-brainer: anyone earning over $250,000 a year is doing awesome. Moreover, if Democrats don’t insist on the expiration of at least some of those “temporary” tax cuts, what’s the point of the deal they cut with the GOP back in 2001?

New deficit: $456 billion.

When it comes to revenues, you have to go where the money is: the wealthy. The rich have gotten richer, which is a big part of the reason we’re in a Depression again. They’re hogging all the goodies. The rest of us can’t spend.

Despite the miserable economy, there are still 2 million American households earning a whopping $250,000 or more per year. (Their average income is $435,000.) If we were to increase these super-rich Americans’ marginal income tax rate from 35 to 50 percent—the same it was during the early 1980s under Reagan—we’d bring in an extra $131 billion a year. If we raised it back to 91 percent—the top rate during the boom years between 1950 to 1963—the Treasury would collect $487 billion.

Budget SURPLUS: $31 billion.

And we haven’t started on corporate taxes.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2010 TED RALL