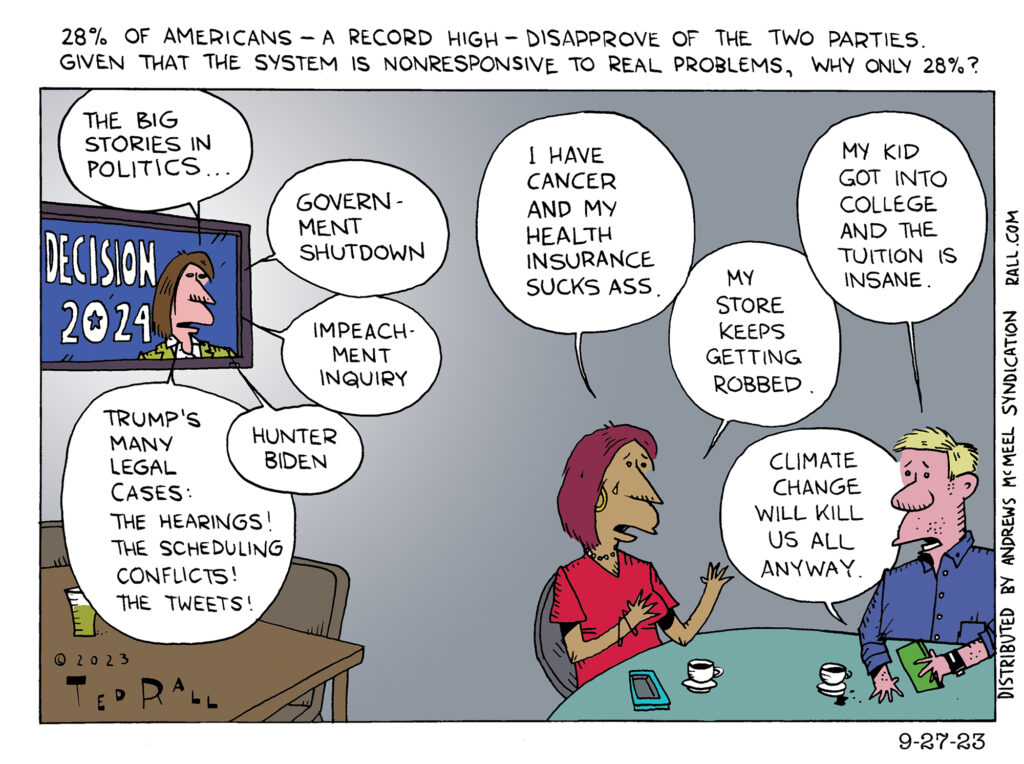

28% of Americans, a record high, tell the Pew Research poll that they are disgusted by both major political parties. It’s not hard to imagine why; the system is distracted by impeachment and other inside the Beltway issues while bread and butter problems that affect ordinary people get ignored by the political class.

Student Loans: A Silent Scandal No More

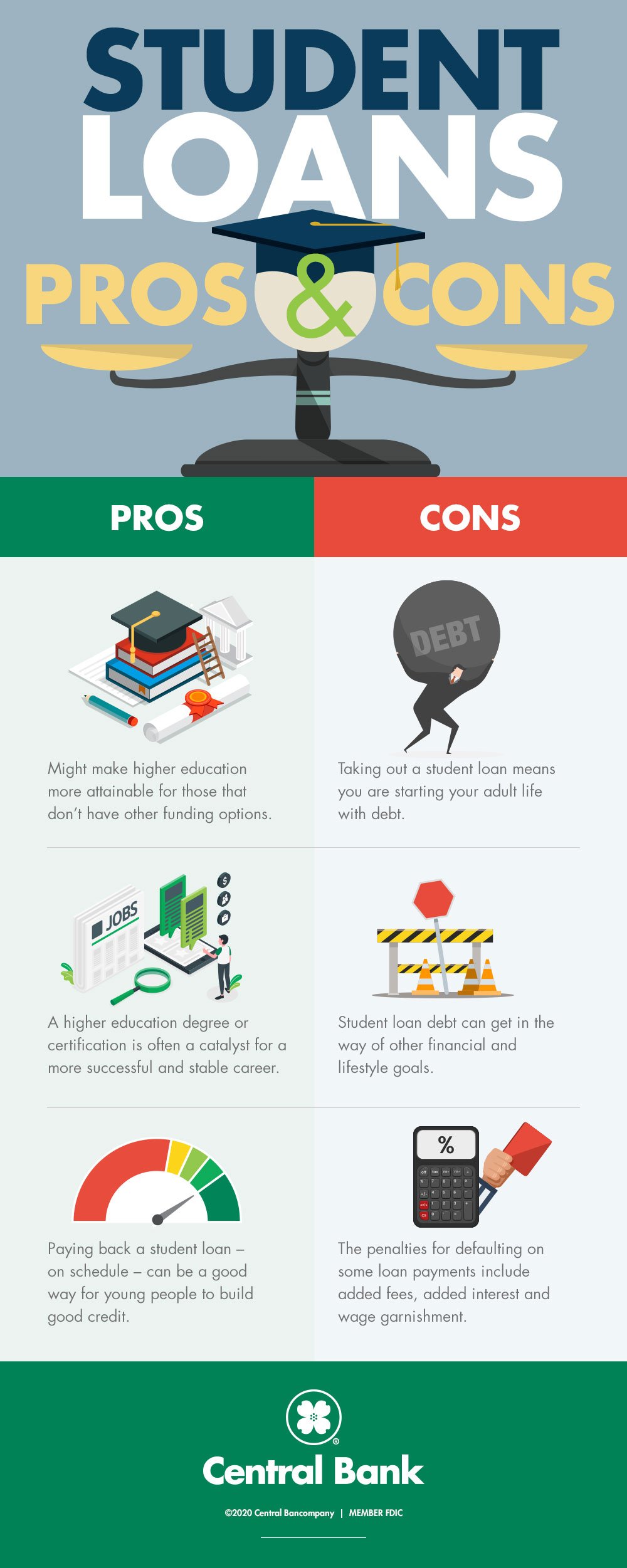

Student loans, long a non-issue that ruined countless lives, have finally become a political flashpoint in the conflict between progressive and moderate Democrats. Yielding to lefties’ pressure after Joe Manchin torpedoed Build Back Better, President Biden has extended Trump’s pandemic relief to 43 million federal borrowers by pausing payments another three months, to May 1.

The issue isn’t going away. 62% of Democratic and 57% of Republican voters aged 18 to 29 told a Harvard Institute of Politics poll that student loan debt is a major problem—a problem they think about when they pay their bills every month.

Left-leaning lawmakers want to go far beyond Biden’s stop-gap extension as well as his long-forgotten campaign promise to cancel $10,000 of debt per borrower. (The average ex-student owes $37,000 in federal loans.) Chuck Schumer, Elizabeth Warren and Ayanna Pressley propose to wipe out $50,000 each; Bernie Sanders and Alexandria Ocasio-Cortez want to forgive all $1.7 trillion.

A bill proposed by Republican Senator Marco Rubio would lower interest payments to zero, instead charging a one-time, non-compounding flat fee that student loan borrowers would pay over the term of their loan.

Our higher-education financing system is a scandal.

My grades and test scores were good enough to get into an Ivy League college. I was smart. But I was still a 17-year-old kid. In 1981 I didn’t know you were supposed to tip your barber, that your major field of study might have no bearing on your future career, or that Manhattan and Long Island were different places.

So signing a student loan agreement committing to repay thousands of dollars from a salary derived from some imaginary job in a mysterious future was a surreal experience.

I sat next to my mom in the lobby of the big bank building in downtown Dayton, clueless. All I knew was that I had to sign a sheaf of incomprehensible documents if I wanted to attend college. As my guidance counselor and teachers and parents had repeatedly warned, without a college degree I would be doomed to subsistence-level fast-food or manual labor—and factory jobs were getting hard to find.

Don’t forget to initial each page.

How much would I earn after graduation? What would be my monthly payment? How does compound interest work? Was 9% a reasonable rate? When would it begin to accrue? What if I became unemployed? I didn’t know and if the banker satisfactorily explained this stuff it didn’t stick to my hippocampus. I invisibly shrugged, hoping that I’d somehow muddle through.

I return to my state of mind 40 years ago whenever I hear someone deplore the ethics of the 15% of student loan borrowers who are in default at any given time. Is an obligation you don’t understand when you agree to it an obligation at all?

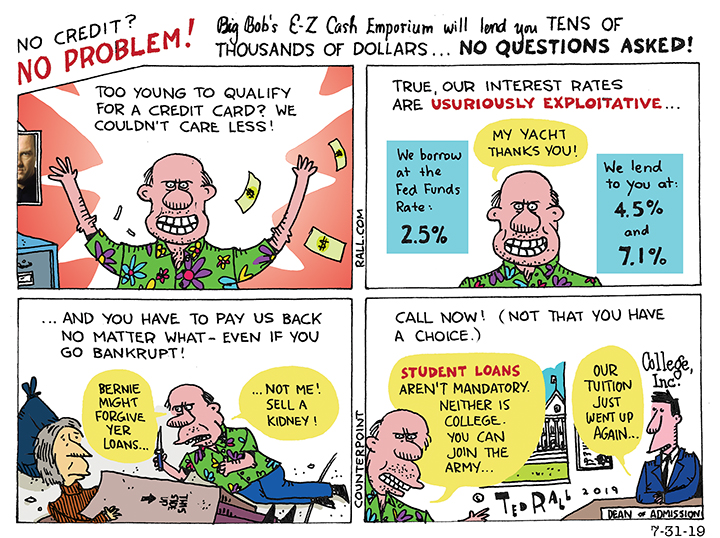

Honoring commitments is important. If you borrow money, you should pay it back. (I did.) But lenders have responsibilities too. As we saw during the subprime mortgage crisis of the late 2000s, the economy suffers when banks recklessly issue loans to borrowers who don’t understand the terms or won’t have enough income or collateral to repay—which is the case for most college loans.

Student loan lending is predicated on the assumption that graduates will be able to pay back what they owe, plus compound interest, out of the higher income they will earn compared to non-graduates. But 57% of student loan borrowers never graduate from college. Most borrowers, therefore, are naïve teenagers with bleak job prospects. Lending to them is as predatory as it gets.

Clemency proposals annoy people who already paid their loans, not to mention those who bypassed college rather than go into debt. Why should taxpayers foot the bill for others’ luxurious college education?

For one thing, post-secondary education is no longer optional. 65% of all job postings require a post-secondary education, according to a study by the Georgetown University Center on Education and the Workplace. As long as that’s the case, Americans will believe there’s a common economic interest in cranking out millions of freshly-minted graduates.

Canceling student loans across-the-board would have a low multiplier effect and thus do little to stimulate the economy. But there would still be advantages for everyone, not just borrowers.

Freeing a generation from debt slavery would provide flexibility and capital for new entrepreneurs and allow do-gooders to pursue work in helping professions with low wages. It would add liquidity to the nearly half of Millennials who report that their loan debts forced them to delay buying a first home by an average of seven years. You may not have gone to college yourself yet you may get to retire earlier because you’ll sell your home to a young couple at a higher price.

College expenses in the U.S. are too damn high, the most expensive system of higher education in the world after the U.K. on paper, but Britain’s are cheaper than ours when adjusted for grants and government-imposed price controls. When half of American borrowers continue to owe an average of $20,000 some 20 years after beginning as a freshman, reform is clearly called for.

One promising development is Secretary of Education Miguel Cardona’s promise to fix broken Bush-era student loan forgiveness programs for those who work in public service, education, healthcare and social work. Byzantine rules and application processes resulted in only 5,500 out of potentially 1 million qualified applicants getting their loans erased in part due to “miscommunication between the Department of Education and the loan servicers, as well as between the servicers and borrowers,” CNN reported about a 2018 General Accounting Office report. But that’s only a start.

Someday, hopefully, college will be free.

Until then, college loans need to be reined in. They’re a big business with no inherent limit upon growth. Colleges and universities have raised tuition and other fees faster than inflation because they know that a wide array of loan packages are available to students and parents. Lenders enjoy a fixed interest rate scheme that not only guarantees them a profit over their own borrowing rates, but also at low risk since it is virtually impossible to discharge student loans in bankruptcy.

These structural problems can be addressed by reducing lenders’ incentives to lend money willy-nilly and by reining in tuition costs. Congress should cap the maximum amount each student can borrow per year at $2500 for those attending community colleges and four-year public universities, and $5000 for those at private institutions. Bankruptcy courts should be given the option to discharge student loan debts. Any college or university that raises overall tuition, housing and other costs faster than inflation should not qualify for federally-subsidized loan payments from their students and ought to lose any federal contracts.

And if it’s really in the public interest for so many millions of young Americans to attend college and university, how does it make sense for educational financing to be a lucrative form of usury?

The federal government ought to take over the lending business from banks, with zero-profit interest fixed at the same rates it pays to holders of Treasury bonds. No one should get rich off the backs of 17-year-old kids seeking to better themselves through education.

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, is the author of a new graphic novel about a journalist gone bad, “The Stringer.” Order one today. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

SYNDICATED COLUMN: No College, No Job. College is Expensive. Is It Any Wonder Students Turn to Porn?

Everybody’s talking about — scratch that. Culture is too atomized for everybody to be talking about anything.

Lots of people who don’t usually cop to knowing about, much less watching, porn — writers at high-end intellectual magazines, columnists for The Washington Post — are talking about Belle Knox, the Duke University freshman who embraced her outing as an adult film actress in an eloquent, feminist theory-imbued attack against slut-shaming.

Social media has responded as you’d expect: lots of mean slut-shaming that proves Knox’s point that “We deem to keep women in a place where they are subjected to male sexuality. We seek to rob them of their choice and of their autonomy. We want to oppress them and keep them dependent on the patriarchy.”

Tabloids and gossip sites are reveling in their usual witches’ brew of judginess and salacious intrigue.

Big corporate media is reacting like George C. Scott finding out his daughter is a whore. Considering that the average age of a journalist is Old Enough to Be Knox’s Mom or Dad, knee-jerk Talibanality comes as little surprise, though quite unpleasant to watch.

About that Post columnist:

Ruth Marcus, Old Enough to Be Knox’s Grandma and apparently a freelance psychologist, calls Knox a “troubled young woman.”

If Marcus hates the sin and not the sinner, it’s hard to tell. Her column drips with condescension and contempt.

“Methinks the freshman doth protest too much,” writes Marcus. Because, you know, like, 18 years old is mature enough to decide which Arabs to shoot, but not to have sex for money.

“Even more heartbreaking is listening to Knox’s still little-girlish voice describing how she’ll tell her parents. ‘I don’t want to,’ she told the Duke Chronicle last month, in the whiny tone of a child told to go to bed.”

Charming.

Marcus goes on. Who could stop her? “She mentioned rough sex, which requires an unpleasant discussion of what kind of pornography we’re talking about here and the increasingly violent nature of the Internet-fueled pornography trade. These are not your father’s Playboys. Letting a man ejaculate on your face is not empowering under anyone’s definition of the term. It’s debasing.”

Two things.

One: bukkake predates the Internet. If Marcus doesn’t know that, or how to Google, she should have spoken to or been edited by someone who does.

Two: what’s sexy and what’s empowering are purely subjective. Knox describes feeling “fear, humiliation, shame” — not from her work, but from neo-Puritan assholes on the Internet giving her a hard time. “Doing pornography fulfills me,” she writes.

Part of respecting women — of being a feminist — is taking them at their word. Thus, in the absence of evidence that Knox is lying or insane, I choose to believe her.

So. Why did Knox become a sex worker? Her answer: “If Duke had given me the proper financial resources, I wouldn’t have done porn. My story is a testament to how fucking expensive school is.”

Media gatekeepers are ignoring it, but this is the real/big story.

Each year in the United States, 12 million freshmen take out student loans. By the time they graduate (or not), they wind up owing $26,000 — plus several times that amount in compound interest payments. In many cities, that’s more than the cost of a house.

Duke University charges Belle Knox $61,000 a year in tuition, room and board. I don’t care how many hours she could have put in at Starbucks; the only way a typical college kid can generate $250,000 in cash over four years is to think outside the box.

Knox isn’t alone. Many college students work as prostitutes.

When I attended Columbia University, I met many students who cut moral and legal corners to make their bursar bills.

I knew students who were call girls, including one who brought her clients to her dorm room to save on hotel rooms. Topless and nude dancers weren’t rare at Columbia. A close friend took advantage of his room’s southern exposure to grow pot plants; he sold his stash out of a deserted Butler Library stack full of 17th century Italian folios. Another pal was banking six figures as a cocaine dealer (it was the ’80s.)

I discovered that one of my classmates was sleeping in the park. There was nothing left after he paid tuition.

One of my buddies, now a minor success in Silicon Valley, had a unique racket. He climbed outside locked campus buildings using grappling hooks. Yes, like a ninja. He entered the chemistry and physics department storerooms through the windows. He then sold the chemicals — including radioactive stuff — to an oily man who worked at the mid-Manhattan consulate of a nation that did not get along with the U.S.

I won’t mention the guy who sold his poo in the Village.

Reagan slashed student financial aid during my freshman year. To pay my way sophomore year, I broke laws.

If I knew then what I know, I wouldn’t have done it. Going into debt or risking jail to pay exorbitant tuition at an “elite” school like Duke or Columbia is insane. You can get an excellent education at any number of cheaper, no-name schools. You can save tens of thousands of dollars by attending a community college for two years, then transferring for junior year; the name on the diploma is what matters.

But that’s the point. I was 18. Like Knox. There’s a reason the military recruits 17- and 18-year-olds. They don’t know anything. I still can’t believe when my mom drove me to the bank to sign the student loan agreement. I was 17. Seriously? I couldn’t vote or drink.

I thought Manhattan was Long Island.

Americans hear a drumbeat of “unless you attend college, your life will suck” propaganda the first 18 years of their lives. Their parents say it. Their teachers say it. Their guidance counselors and the media say it. The college/university industry spends millions to advertise the message that the more you spend on tuition, the more you’ll earn during your lifetime.

The President says it too.

Everyone says college is a must and that expensive college is better than cheap college. Of course Belle Knox and young Ted Rall and 20 million new suckers every year believe it.

Ruth Marcus concludes: “Knox’s pathetic story wouldn’t be worth examining — exploiting? — if it didn’t say something deeper about the hook-up culture run amok and the demise of shame.”

Wrong.

Belle Knox has nothing to be ashamed of.

The real sluts are the cash-whore trustees of Duke University, who are sitting on top of a $6 billion endowment, and the overpaid college and university officials who have jacked up tuition at twice the inflation rate year after year.

(Support independent journalism and political commentary. Subscribe to Ted Rall at Beacon.)

COPYRIGHT 2014 TED RALL, DISTRIBUTED BY CREATORS.COM

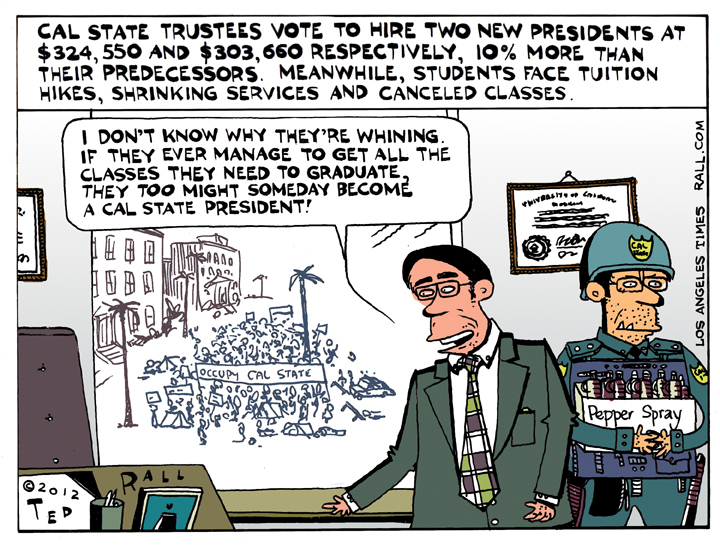

Los Angeles Times Cartoon: Cal State Presidents Cash In

I draw cartoons for The Los Angeles Times. This week’s offering: Cal State trustees have voted to hire two new presidents at high salaries, 10% more than their predecessors. Meanwhile, students face class cancellations and budget cuts.

SYNDICATED COLUMN: Ah, To Be Young And In Hate

America’s New Radicals Attack a System That Ignores Them

“Enraged young people,” The New York Times worries aloud, are kicking off the dust of phony democracy, in which “the job of a citizen was limited to occasional trips to the polling places to vote” while decision-making remains in the claws of a rarified elite of overpaid corporate executives and their corrupt pet politicians.

“From South Asia to the heartland of Europe and now even to Wall Street,” the paper continues, “these protesters share something else: wariness, even contempt, toward traditional politicians and the democratic political process they preside over. They are taking to the streets, in part, because they have little faith in the ballot box.”

The rage of the young is real. It is justified. It is just beginning to play out.

The political class thinks it can ignore the people it purports to represent. They’re right–but not forever. A reckoning is at hand. Forty years of elections without politics will cost them.

Americans’ pent-up demand for a forum to express their disgust is so vast that they are embracing slapdash movements like Occupy Wall Street, which reverses the traditional tactic of organizing for a demonstration. People are protesting first, then organizing, then coming up with demands. They have no other choice. With no organized Left in the U.S., disaffected people are being forced to build resistance from the ground up.

Who can blame young adults for rejecting the system? The political issue people care most about–jobs and the economy–prompts no real action from the political elite. Even their lip service is half-assed. Liberals know “green jobs” can’t replace 14 million lost jobs; conservatives aren’t stupid enough to think tax cuts for the rich will help them pay this month’s bills.

The politicians’ only real action is counterproductive; austerity and bank bailouts that hurt the economy. Is the government evil or incompetent? Does it matter?

Here in the United States, no one should be surprised that young adults are among the nation’s angriest and most alienated citizens. No other group has been as systematically ignored by the mainstream political class as the young. What’s shocking is that it took so long for them to take to the streets.

Every other age groups get government benefits. The elderly get a prescription drug plan. Even Republicans who want to slash Medicaid and Medicare take pains to promise seniors that their benefits will be grandfathered in. Kids get taken care of too. They get free public education. ObamaCare’s first step was to facilitate coverage for children under 18.

Young adults get debt.

The troubles of young adults get no play in Washington. Pundits don’t bother to debate issues that concerns people in their 20s and 30s. Recent college graduates, staggering under soaring student loan debt, are getting crushed by 80 percent unemployment–and no one even pretends to care. Young Americans tell pollsters that their top concerns are divorce, which leaves kids impoverished, and global warming. Like jobs, these issues aren’t on anyone’s agenda.

This pot has been boiling for decades.

In 1996 I published “Revenge of the Latchkey Kids,” a manifesto decrying the political system’s neglect and exploitation of Generation X, my age cohort, which followed the Baby Boomers.

We were in our 20s and low 30s at the time.

Un- and underemployment, the insanity of a job market that requires kids to take out mortgage-sized loans to attend college just to be considered for a low-paid entry-level gig in a cube farm, the financial and emotional toll of disintegrating families, and our fear that the natural world was being destroyed left many of my peers feeling resentful and left out–like arriving at a party after the last beer was gone.

Today the oldest Gen Xers are turning 50. Life will always be harder for us than it was for the Boomers. If I had to write “Latchkey Kids” for today’s recent college grads, it would be bleaker still. Today’s kids–demographers call them Gen Y–have it significantly worse than we did.

Like us, today’s young adults get no play from the politicians.

The debts of today’s Gen Yers are bigger ($26,000 in average student loans, up from $10,000 in 1985). Their incomes are smaller. Their sense of betrayal, having gone all in for Obama, is deeper.

Young adults turned out big for Obama in 2008, but he didn’t deliver for them. They noticed: The One’s approval rating has plunged from 75 percent among voters ages 18-29 when he took office in January 2009 to 45 percent in September.

Politicians like Obama ignore young adults, especially those with college degrees, at their–and the system’s–peril. Now, however, more is at stake than Obama and the Democrats’ 2012 election prospects. The entire economic, social and political order faces collapse; young people may choose revolution rather than accept a life of poverty in a state dedicated only to feeding the bank accounts of the superrich.

As Crane Brinton pointed out in his seminal book “The Anatomy of Revolution,” an important predictor of revolution is downward mobility among strivers, young adults whose education and ambition would traditionally have led to a brighter future.

In February Martin Wolf theorized in The Financial Times that the Arab Spring rebellions in Egypt and Tunisia owed their success to demographics; those countries have more young people than old ones. On the other hand “middle-aged and elderly rig political and economic life for their benefit in the U.K. [he could also have said the U.S.]: hence the way in which policies on housing or education finance are weighted against the young.”

Right here and right now, though, the young and the old are on the same side. Though the young are getting screwed the hardest, almost everyone else is getting screwed too. And with 80 percent unemployment, the young have a lot of free time to rise up.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2011 TED RALL