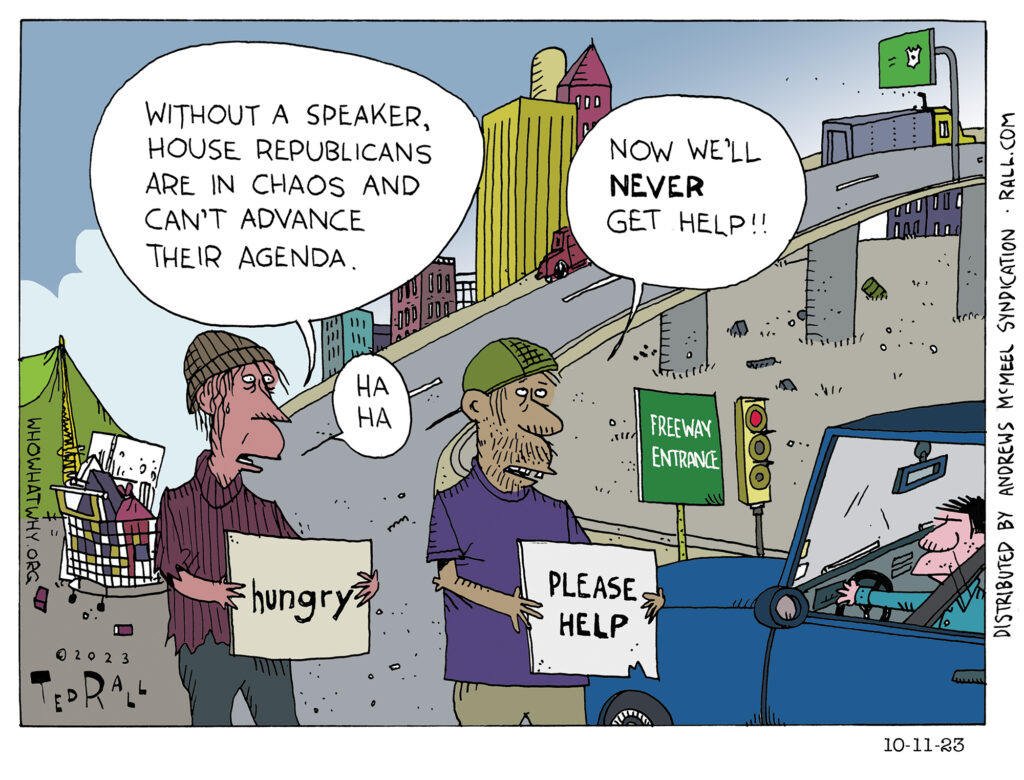

Without a Speaker of the House, Republicans aren’t able to advance their agenda. Is that necessarily a terrible thing?

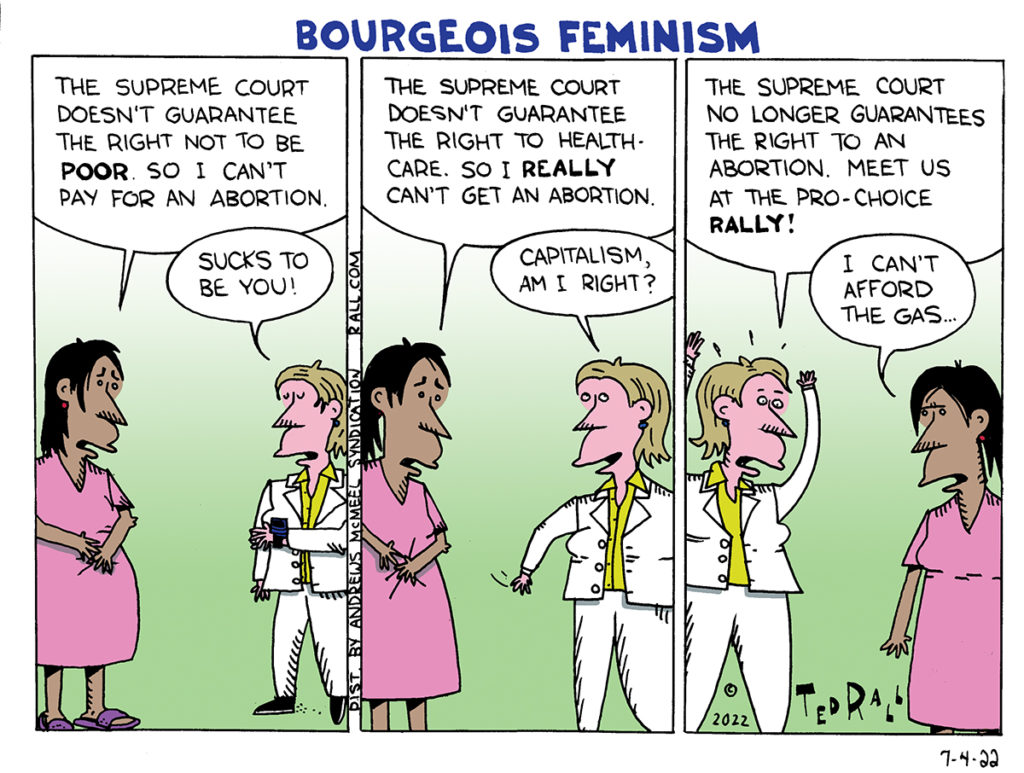

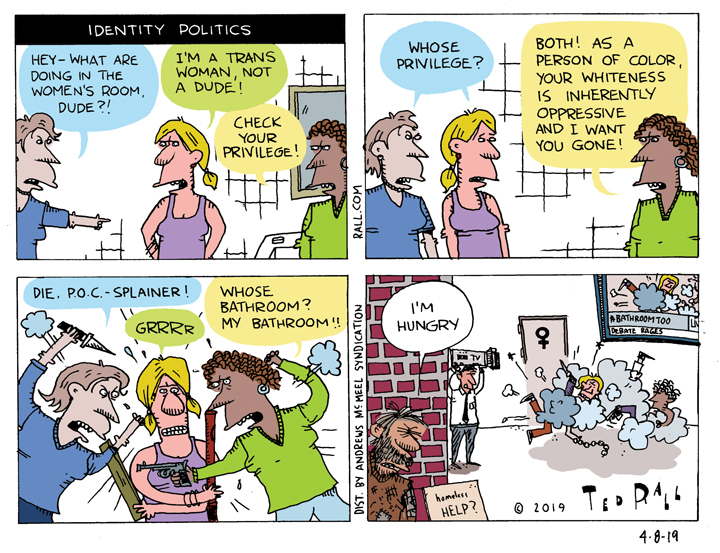

Identity Politics Made Simple

For most of the 20th century left-of-center politics was defined by class struggle between the rich and the poor. Now the left has been completely subsumed by identity politics, the struggles for historically disadvantaged demographic groups for equality. Unfortunately the class struggle (which largely drove the oppression of women and minorities) has been all but forgotten by mainstream liberal politicians and political parties.

SYNDICATED COLUMN: How I Found Out That the Courts Are Off-Limits to the 99%

I’m suing the Los Angeles Times. I’m the plaintiff. I’m the one who was wronged. The Times should be defending themselves from my accusations that they fired and libeled me as a favor to a police chief.

I’m suing the Los Angeles Times. I’m the plaintiff. I’m the one who was wronged. The Times should be defending themselves from my accusations that they fired and libeled me as a favor to a police chief.

But this is America.

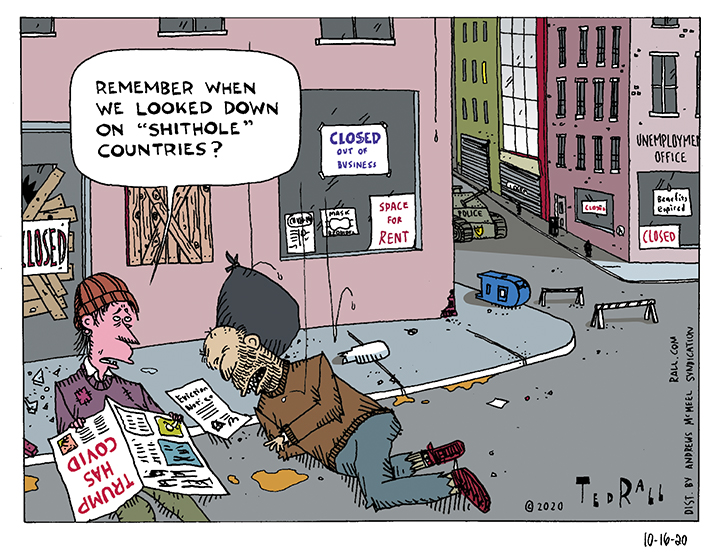

Deep-pocketed defendants like the Times — owned by a corporation with the weird name Tronc and a market capitalization in excess of $400 million — are taking advantage of America’s collapsing court system to turn justice on its head. In worn-out Trump-era America, the corruption and confusion that used to be associated with the developing world has been normalized.

If you’re a big business like Tronc, you may be the defendant on paper but you have all the advantages in court. Your money allows you to put the plaintiff on the defense. You’re equal in the eyes of the law — theoretically. But it doesn’t feel like justice when the victim has to defend himself from the criminal. It’s like that song “Lola,” in which the Kinks sang “girls will be boys and boys will be girls”; the courts system is a mixed up, muddled up, shook up world.

States like California passed anti-SLAPP laws to defend individuals with modest incomes (like me) against deep-pocketed plaintiffs (like the Times) that file frivolous lawsuits to intimidate and harass their critics. After an anti-SLAPP motion is filed, the case freezes until a judge decides whether the case is meritorious. If the judge says it’s frivolous, it’s dismissed and the poor individual defendant gets his or her attorney’s fees paid by the deep-pocked corporation plaintiff.

After I sued them for defamation and wrongful termination, the Times filed three “anti-SLAPP” motions against me. So if the judge decides I don’t have a good case, this middle-class individual plaintiff will have to pay deep-pocketed defendant Tronc’s legal fees. The Troncies want at least $300,000.

Talk about topsy-turvy! The legislature should fix this law but they won’t because there’s zero political movement in that direction. I may be the only journalist to have criticized anti-SLAPP laws in a public forum. Articles about anti-SLAPP feature nothing but praise.

There were three motions. I lost one on June 21st, against the individual Times employees and executives involved in libeling me. (I plan to appeal.) That loss prompted a parting of ways with my attorneys. What followed was a month of representing myself pro se (in California they call it in pro per).

I now have new lawyers, and we’re waiting to hear how I did arguing against ace lawyer Kelli Sager’s anti-SLAPP motions for the Times and Tronc in LA Superior Court on July 14th. It sucked. But representing myself gave me a full-immersion crash course in just how messed up the courts really are.

The big thing I learned was that poor people have zero access to justice.

Nor do the middle class.

After the June 21st debacle, a semi-retired lawyer friend advised me to file a Motion for Reconsideration, a request to the judge to take another look and perhaps realize that he made some mistakes. The law gives you 10 days to file.

My Motion for Reconsideration was one of numerous motions I would have to draft and file myself while pro se. It was incredibly expensive, wildly burdensome and so daunting I bet 99% of people without a lawyer would throw up their hands and give up.

I’m the 1%.

I’m a writer. I went to an Ivy League school; I was a history major so I’m good at research. I used to work at a bank, where I worked on legal documents so I’m familiar with legalese. So I researched what works and doesn’t work in a Motion for Reconsideration. I crafted an argument. I deployed the proper tone using the right words and phrases.

Most people, not having the necessary skills or educational attainment, wouldn’t stand a prayer of writing a legal brief like this motion. Mine may fail — but the judge might read it and take it seriously because it’s written correctly.

I called the court clerk to ask how to file my motion. She was incredibly curt and mean. I’m a New Yorker so I persisted, but I could imagine other callers being put off and forgetting the whole thing.

Schedule a date for your hearing on the court’s website, the clerk told me. Good luck! The site had an outdated interface, was loaded with arcane bureaucratic jargon and a design that’s byzantine and hard to navigate. If English is your second language, forget it.

Eventually I found the place to reserve a hearing date — where I learned about the $540 filing fee.

Payable only by credit card.

No debit cards.

No Amex.

Protracted litigation against a well-funded adversary like the Times/Tronc could easily require dozens of $540 filing fees. The poor need not apply. Most Americans don’t have that kind of money. And what about people who scrape up the dough but don’t have plastic?

$10 would be too much. $540 is frigging obscene.

I paid the fee, printed out the receipt as required, stapled it to the back of my multiple required copies of the motion and went to the Stanley Mosk Courthouse to file it. As I waited in Room 102 to have my motions stamped by a clerk, I studied the many working-class people waiting in the same line.

Here too, there is no consideration for the people. The clerk’s office is open Monday to Friday 8:30 to 4:30. Most people work during those hours. Gotta file something? You have to take time off. Parking? Expensive and far away.

I have a dream.

I dream of a court system dedicated to equal justice before the law — where anyone can file a motion, where there are no filing fees, where the courthouse is open on weekends, where you can file motions by uploading them online and there’s free parking for citizens conducting business in the people’s house.

But Tronc wouldn’t like that system.

(Ted Rall (Twitter: @tedrall) is author of “Trump: A Graphic Biography,” an examination of the life of the Republican presidential nominee in comics form. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

SYNDICATED COLUMN: 50%+ of Americans Have Been Poor, and Capitalism Thinks That’s Awesome

Odds are, you are poor. Or you’ve been poor.

Conventional wisdom — i.e., what the media says, not what most people think — repeatedly implies that poverty is a permanent state that chronically afflicts a relatively small number of Americans, while the rest of us thrive in a vast, if besieged, middle class. In fact, most Americans between age 25 and 75 have spent at least one year living under the poverty line.

“One of the biggest myths about poverty in the United States is that a relatively small segment of the population is poor, and that this represents a more or less permanent underclass,” Columbia University economist and social work professor Irwin Garfinkel tells Columbia magazine. “But poverty is quite dynamic. Lots of people move in and out of poverty over the course of their lives. And it doesn’t take much for people at the edge to lose their footing: a reduction in work hours, an inability to find affordable day care, a family breakup, or an illness — any of these can be disastrous.”

Even if you bounce back, the effects of these financial setbacks linger. For young adults, attending cheaper colleges or passing up higher education — or being unable to afford to take a low-paid internship — burdens them with opportunity costs that hobble them the remainder of their lives (which will likelier end sooner). Debts accrue with compound interest and must be repaid; damaged credit ratings block qualified buyers from purchasing homes. Diseases go undetected and untreated during periods without healthcare. Gaps on resumes are a red flag for employers.

Americans pay a price for the boom-and-bust cycle of capitalism. To find out exactly how high the cost is, Professor Garfinkel and his colleagues at Columbia have created the Poverty Tracker, dubbed “one of the most richly detailed studies of poverty ever undertaken in the United States.” The Poverty Tracker is “a meticulous long-term survey of 2,300 New York households across all income levels…for at least two years” that aims “to create a much more intimate and precise portrait of economic distress than has ever been conducted in any US city.”

Initial findings were distressing: “While the city’s official poverty rate is 21%, the Columbia researchers found that 37% of New Yorkers, or about 3 million people, went through an extended period in 2012 when money was so tight that they lost their home, had their utilities shut off, neglected to seek medical treatment for an illness, went hungry, or experienced another ‘severe material hardship,’ as the researchers define such extreme consequences.”

Wait, it’s even worse than that:

“Even the 37% figure understates the number of New Yorkers who endured tough times in 2012. The researchers estimate that two million more endured what they call ‘moderate material hardship,’ which, as opposed to, say, losing one’s home or having the lights shut off, might involve merely falling behind on the rent or utility bills for a couple of months. Many others were in poor health. Indeed, the researchers found that if you add together all of those who were in poverty, suffered severe material hardship, or had a serious health problem, this represented more than half of all New Yorkers [emphasis is mine].”

The researchers hope that “they will have enough data to begin helping public authorities, legislators, foundations, nonprofits, philanthropists, and private charities address the underlying problems that affect the city’s poor” by the end of 2014.

Nationally, more than 35% of all Americans are currently ducking calls from collection agencies over unpaid debts.

What can be done?

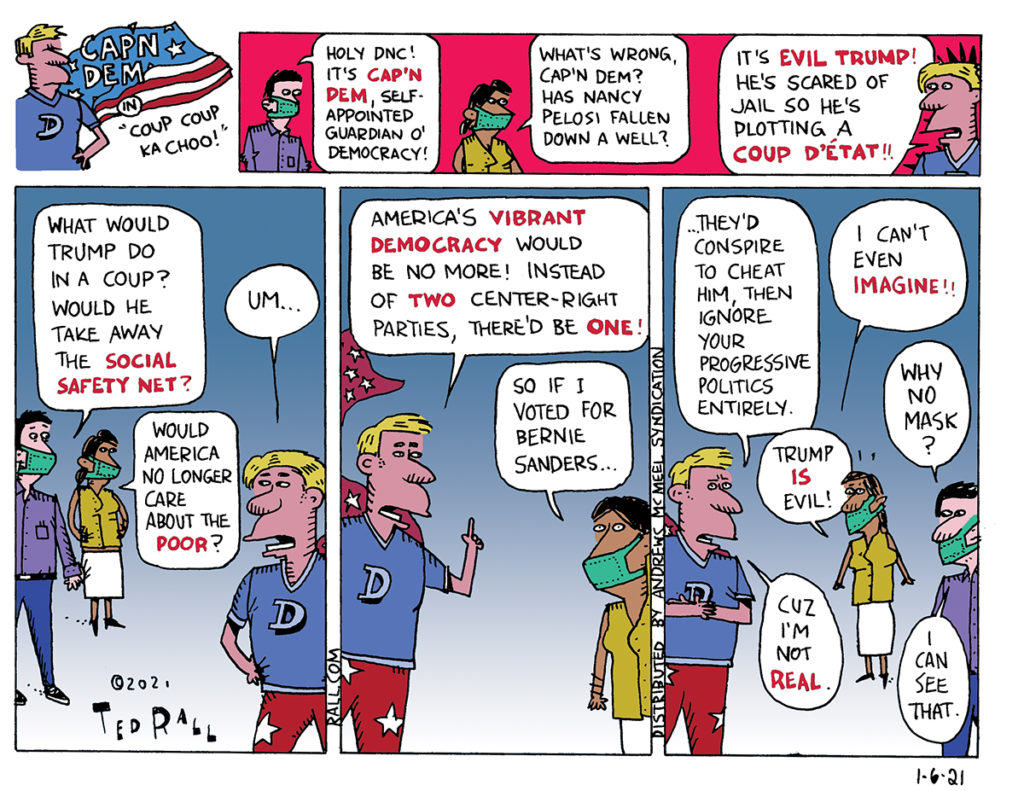

Under this system? Not much. Democrats, who haven’t even proposed a major anti-poverty program since the 1960s, aren’t meaningfully better on poverty than Republicans.

As things stand, the best we can hope for from the political classes are crumbs: a few teeny-weeny proposals for wee reforms.

Like expanding day-care programs. More school lunches. Housing subsidies. “Additional investments in food programs.”

A drop in the bucket in an ocean of misery.

The Poverty Tracker shows that poverty is a huge problem in the United States. Unfortunately its authors, who draw their salaries from an institution intimately intertwined with monied elites, dare not openly suggest what they know to be true, that the key to eliminating poverty is to get rid of its root cause: capitalism.

(Ted Rall, syndicated writer and cartoonist, is the author of “After We Kill You, We Will Welcome You Back As Honored Guests: Unembedded in Afghanistan,” out Sept. 2. Subscribe to Ted Rall at Beacon.)

COPYRIGHT 2014 TED RALL, DISTRIBUTED BY CREATORS.COM

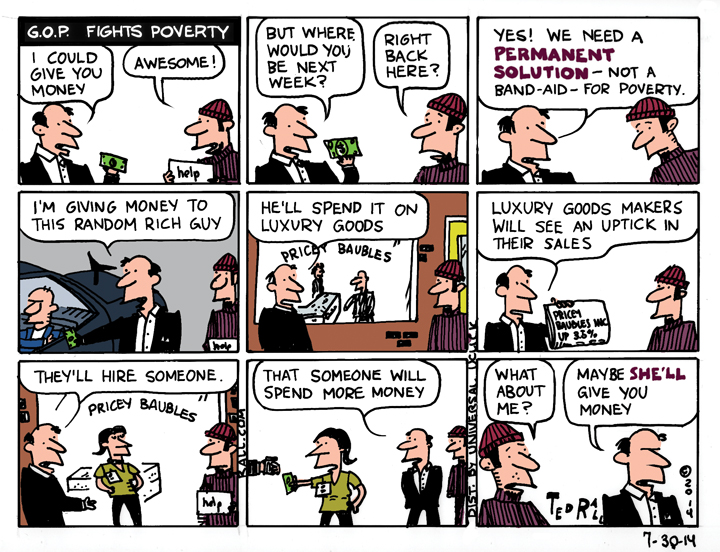

The GOP Finally Takes on Poverty

Republican Congressman and former vice presidential candidate Paul Ryan, infamous for budget proposals that denigrate and starve the downtrodden, has changed tack with an anti-poverty proposal that actually includes safety-net items like expanding the Earned Income Tax Credit. Still, the Republican Party remains in thrall to trickle-down economic theories that, if they worked, would take years to help poor people who need money now.