As a news junkie and student of the human condition, it takes a lot to make my blood come to a full boil. It takes even more to make me sympathize with wealthy corporations. Hand it to Gov. Jerry Brown — he managed to pull off both feats with the news that he diverted $350 million from California’s share of the 2012 national mortgage settlement in order to reduce the state’s 2013 budget deficit.

Now that California is enjoying a budget surplus, a coalition of homeowner advocates and religious organizations has filed suit against the state to force Brown to restore the money.

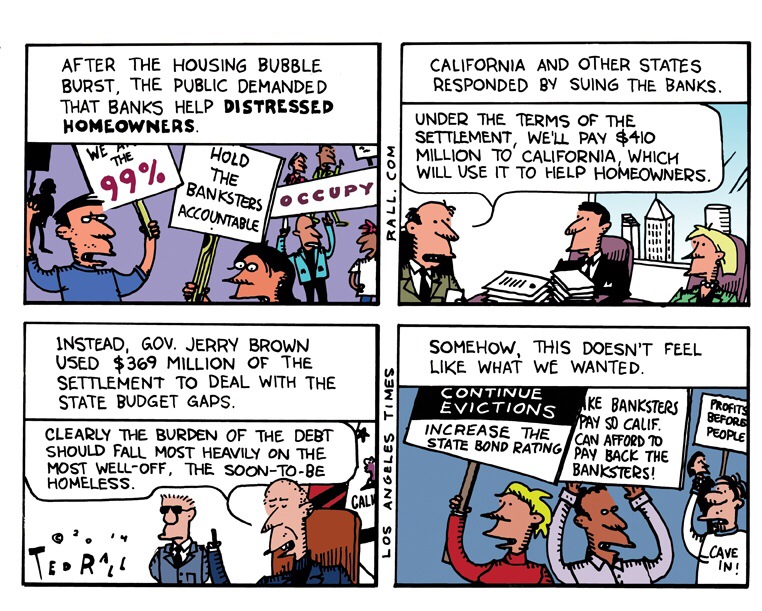

Back in 2008-09, the real estate bubble burst, taking the global economy with it. By many measures, especially real unemployment and median wages, we still haven’t recovered.

By 2010 a political consensus had formed. Though politicians were partly to blame, the worst offenders were the giant “too big to fail” banks that had knowingly approved loans to homebuyers who couldn’t afford to pay them back, sold bundles of junk mortgage derivatives to unsuspecting investors and secretly hedged their bets against their clients. After the house of cards came down, they played the other side. They cashed in their chips, refused to refinance mortgages even though interest rates had fallen and deployed “robo-signers” to illegally evict hundreds of thousands of homeowners — including people who had never missed a payment — to ding them with outrageous late fees on their way to profitable (for the banks) foreclosure.

On the Left, anger at the banks coalesced around the Occupy Wall Street movement. Though less widely reported, anti-bank sentiment also found a home in the Tea Party.

Politics ultimately play out in the courts. Lawsuits filed by state attorney generals forced the banks to the bargaining table. In 2012 they agreed to cough up $26 billion as penance.

The money was supposed to compensate people who had lost their homes and to help those who were hanging on by a thread avoid eviction, either by refinancing at lower rates or writing down principal to reflect lower real estate prices.

Enter the governors.

Jerry Brown wasn’t unique. Cash-hungry states siphoned off half of their share of the mortgage settlement to plug holes in their budgets.

We will never know how many families became homeless as a result.

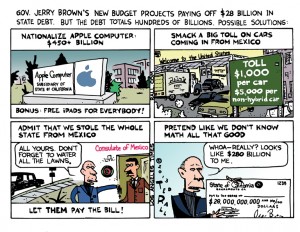

The more you think about it, the more disgusting it is. Obviously it’s important for the state to get its fiscal house in order. But not at the expense of those least able to bear the burden. Desperate families lost — and are still losing — their homes so that holders of California’s state debt, much of it held by the same banks who caused the mortgage crisis, can be repaid.

This outrage is not without precedent.

Rather than the anti-smoking and health campaigns they were supposed to launch, the states siphoned off 47% of the $7.9 billion they received from the 1998 tobacco settlement for general budget purposes.

How many kids might have been reached by tobacco education programs that never got off the ground? How many will die of lung cancer? “Fifteen years after the tobacco settlement, our latest report finds that states are continuing to spend only a miniscule portion of their tobacco revenues to fight tobacco use,” the Campaign for Tobacco-Free Kids said in 2014. In Fiscal Year 2014, the states will collect $25 billion in revenue from the tobacco settlement and tobacco taxes, but will spend only 1.9 percent of it – $481.2 million – on programs to prevent kids from smoking and help smokers quit. This means the states are spending less than two cents of every dollar in tobacco revenue to fight tobacco use.”

This is the kind of behavior that prompts conservatives to characterize these settlements as government shakedowns of big business. It’s hard to disagree. As slimy as the banksters were and are — they’re sabotaging political solutions to the foreclosure crisis — they’re just greedy bastards doing what greedy bastards do. Public officials, on the other hand, are supposed to be on our side.

What Brown and his fellow governors have done with the mortgage settlement money is even more nauseating.