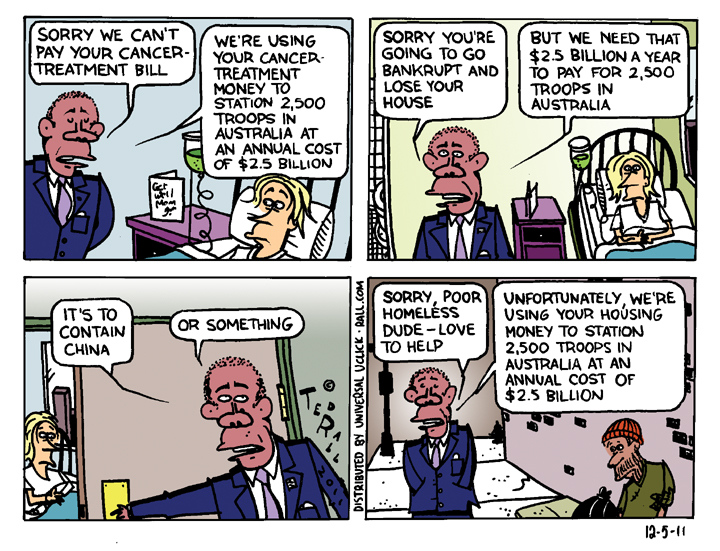

When it comes to shipping weapons to countries like Ukraine and Taiwan, money is no object. Billions of dollars are freely flowing. Meanwhile, Americans are lacking for basic needs like running water. In Jackson, Mississippi, there’s still no sign that residents will have clean water anytime soon.

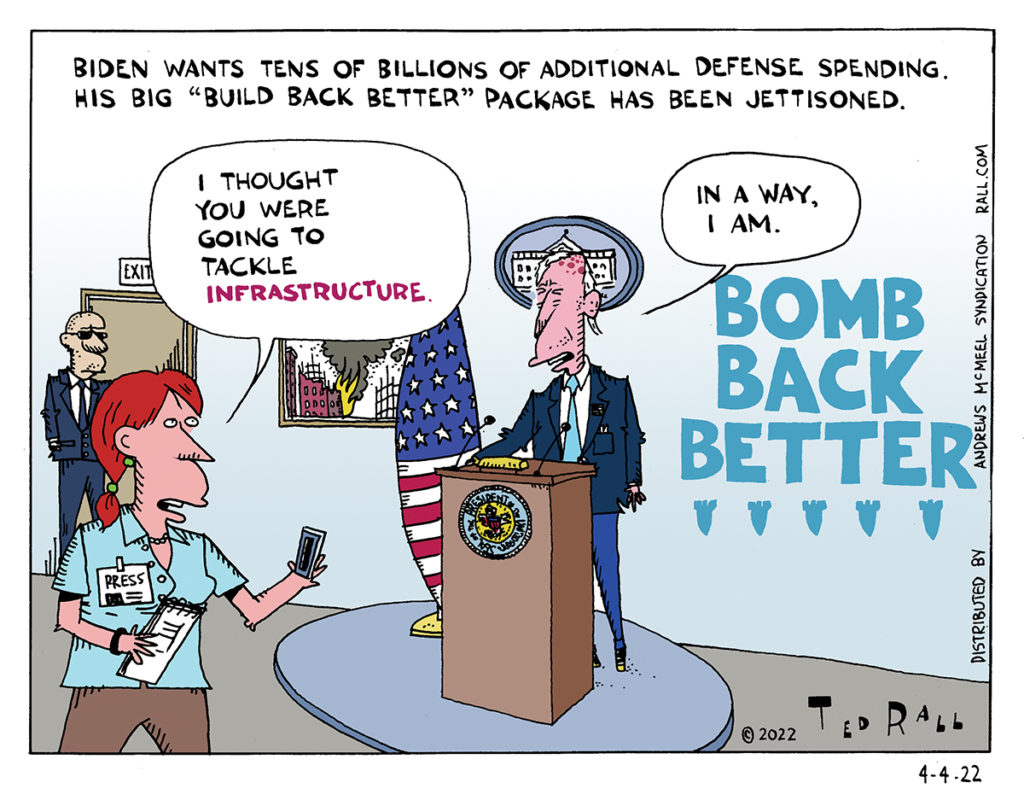

Bomb Back Better

The Build Back Better policy package was supposed to be the centerpiece of the Biden administration’s infrastructure-centered agenda. But now it’s dead because conservative Democrats won’t support it. So the new White House budget doesn’t include it but it ramps up defense spending by billions of dollars.

California Recalls to SCOTUS Hacks to General Miley. This new podcast has it all!

It’s an ADD episode where Ted and Scott discuss everything from SCOTUS political hacks to Covid-19 booster shots to outlawing drones. Also we ask the question: where do you buy YOUR submarines?

The Data Is Clear: Progressives Should Boycott Biden

Once again the Democratic Party is asking progressives to vote for a presidential nominee who says he disagrees with them about every major issue. This is presented as an offer they cannot refuse. If they cast a protest vote for a third-party candidate like the unionist and environmentalist Howie Hawkins of the Greens or stay home on that key Tuesday in November, Donald Trump will win a second term—which would be worse than Biden’s first.

Which is better for the progressive movement? Fall into the “two party trap” and vote for Biden, or refuse to be coopted and possibly increase Trump’s reelection chances?

My new book Political Suicide: The Fight for the Soul of the Democratic Party documents the last half-century of struggle between the party’s left-leaning voters and its right-leaning leadership class. History is clear. When progressive voters compromised their values by supporting corporatist candidates, they were ignored after the election. Only when they boycotted a general election did the DNC start to take them seriously.

Throughout the 1980s party bigwigs manipulated the primaries in favor of establishment corporatist candidates over insurgent progressives: Jimmy Carter over Ted Kennedy in 1980, Walter Mondale and Michael Dukakis over Jesse Jackson in 1984 and 1988. Democrats were united but unenthused; all three lost.

Jimmy Carter won once, and Bill Clinton and Barack Obama each won two terms, all three with progressive support. Democratic victories didn’t help progressives.

Most people have forgotten that Carter was the first of a string of conservative Democratic presidents. He brought back draft registration. The “Reagan” defense buildup actually began under Carter, as Reagan himself acknowledged. Carter provoked the Tehran hostage crisis by admitting the despotic Shah to the U.S., boycotted the Moscow Olympics and armed the Afghan mujahdeen who morphed into Al Qaeda.

Carter became the first president since FDR not to propose an anti-poverty program. Instead, he pushed a right-wing idea, “workfare.”

Progressives got nothing in return for their votes for Jimmy Carter.

Like Carter, Clinton and Obama governed as foreign policy hawks while ignoring pressing domestic issues like rising income and wealth inequality. Clinton pushed through the now-disgraced 1994 crime bill that accelerated mass incarceration of people of color, signed the North American Free Trade Agreement that gutted the Rust Belt and sent hundreds of thousands of jobs overseas, and ended “welfare as we know it,” massively increasing homelessness. Obama bailed out Wall Street while ignoring Main Street, smashed the Occupy Wall Street movement and supported Al Qaeda affiliates that destroyed Libya and Syria.

There was only one arguably progressive policy achievement over those 16 years: the Affordable Care Act, which originated in the bowels of the conservative Heritage Foundation think tank.

Progressives kept holding their noses and voting for Democrats. Democrats took them for granted. Democrats didn’t push to increase the minimum wage. They watched silently as generation after generation succumbed to student loan debt. As the earth kept burning, they hardly lifted a finger to help the environment except for symbolic actions like Obama’s fuel efficiency regulations, which required less than automakers were doing by themselves.

Personnel, they say in D.C., is policy. Clinton had one progressive in his cabinet for his first term, Labor Secretary Robert Reich. Obama had none. Citigroup chose his cabinet.

After the defeat of Bernie Sanders in 2016, progressives tried something new. Millions of disgruntled Sanders primary voters either stayed home, voted for Trump or cast votes for third-party candidates like Jill Stein. Hillary Clinton, who was so sure she could take progressives for granted that she put Sanders at 39th on her list of vice presidential picks, was denied her presumptive shoo-in victory. (Don’t blame Stein. Adding all of her votes to the Hillary Clinton column would not have changed the result.)

Three years later, something remarkable happened. Most presidential hopefuls in the 2020 Democratic primary campaign emerged from the centrist corporatist wing of the Democratic Party yet felt pressured to endorse important progressive policy ideas. Kamala Harris, Cory Booker, Amy Klobuchar, Pete Buttigieg and even Michael Bloomberg came out in favor of a $15-an-hour minimum wage. Most of the mainstream candidates proposed some sort of student loan forgiveness and Medicare For All. Nearly all support a Green New Deal.

What forced the Democratic Party to shift left after decades of moving to the right? Fear that progressives will withhold their votes this coming November. After years of empty threats from progressives, the November 2016 voter boycott proved they wouldn’t sell their votes without getting something in return.

The answer to the question, what should progressives do, is easy in the long term. Progressives should boycott Democratic candidates who don’t credibly pledge to support progressive policies. Biden says he would veto Medicare For All. He opposes a Green New Deal as well as student loan forgiveness. He is hawkish on Russia and Venezuela. He doesn’t want your vote. Why give it to him for free?

The trouble is, every election is also about the short term. Progressive voters have to game out the next four years.

If Trump wins, he may have the opportunity to appoint another Supreme Court justice. He will certainly appoint more federal judges. He will continue to coddle hate groups and spew lies. Many of the weak and vulnerable will suffer. On the other hand, activism will be sustained. Resistance and possibly even revolutionary change may emerge. Trump will be a lame duck likely wallowing in scandal; very few presidents get much if anything done during their second terms.

If Biden wins, his Supreme Court picks may not be significantly more to the left then Trump’s. He is likelier than Trump, who shows restraint on interventionism and ended the occupation of Afghanistan, to start a new war. Big problems will get small solutions or none at all. Streets will be quiet. If there are any demonstrations, for instance by Black Lives Matter, his Department of Homeland Security will suppress it as Obama did to Occupy. As under Bill Clinton and Barack Obama, the left will go back to sleep. Progressives will watch Biden appoint one corporatist cabinet member after another as their dreams of making the country a better place fade away.

And in 2024, we will again face a choice between a rabid right-wing Republican and a wimpy sell-out Democrat. This election, Democrats will say as they always do, is too important for ideological purity. Progressives should wait until some future election when less hangs in the balance. Perhaps in 2028? Maybe 2032? 2036?

(Ted Rall (Twitter: @tedrall), the political cartoonist, columnist and graphic novelist, is the author of the biography “Political Suicide: The Fight for the Soul of the Democratic Party.” You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

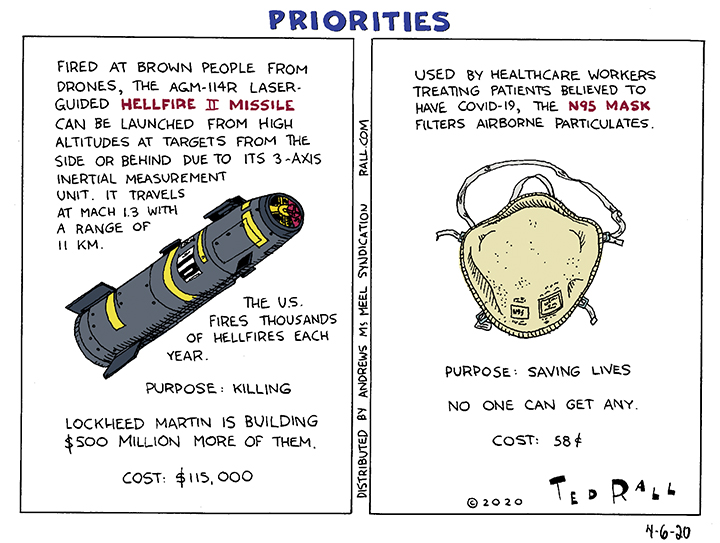

Sick from Our Sick Priorities

What a society spends its resources on reveals its priorities. The United States military has endless resources and massive budgets which it uses to slaughter people around the world for fun and profit. Now the United States healthcare system is under attack by the COVID-19 pandemic, and healthcare workers (not to mention ordinary citizens) can’t even find a $0.58 face mask.

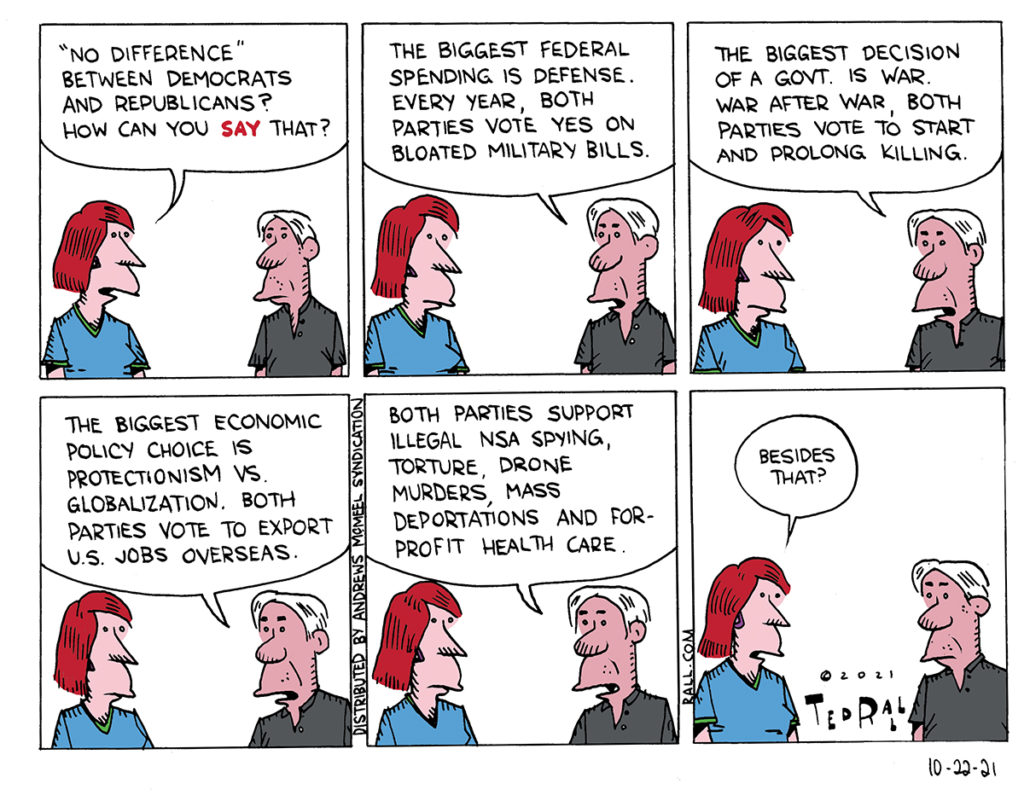

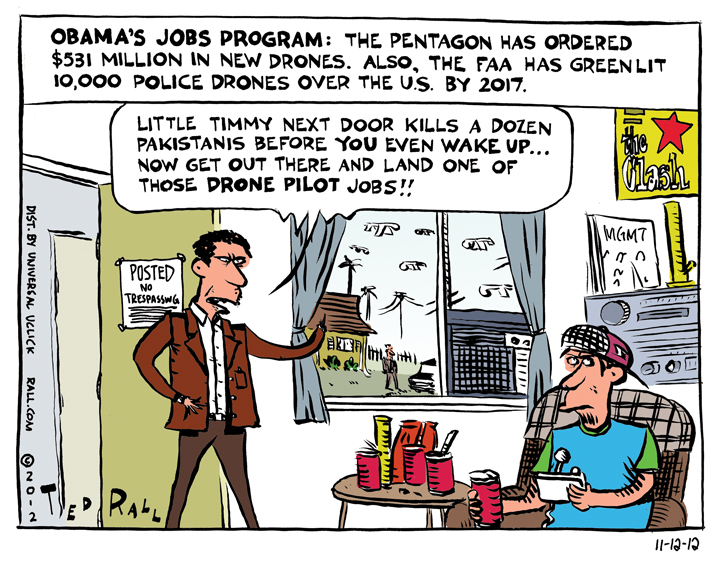

SYNDICATED COLUMN: Military Spending is the Biggest Scam in American Politics

Military spending is the biggest waste of federal taxdollars ever. Both political parties are equally complicit.

Military spending is the biggest waste of federal taxdollars ever. Both political parties are equally complicit.

The militarism scam is the best-kept secret in American politics.

When you think about it — but no one in the halls of Congress ever does — it’s hard to think of a country that has less to fear than the United States. Two vast oceans eliminate our vulnerability to attack, except by countries with sophisticated long-range ballistic missiles (5 out of 206 nations). We share long borders with two nations that we count as close allies and trading partners.

Historically, the U.S. has only faced an invasion once, by the British during the War of 1812. (There have been other minor incursions, by Mexico during the 19th century and the Japanese occupation of two remote islands in the Aleutian chain during World War II. The Pearl Harbor attack was a raid, not an invasion.)

Objectively, we have little to worry about beside terrorism — and that’s a job for domestic police and intelligence agencies, not the military. Yet a whopping 54% of discretionary federal spending goes to the Pentagon. The Bush Administration put the Afghanistan and Iraq wars “off the books” of the Pentagon budget. And that’s not counting interest on debt or benefits paid out for old wars. We’re still paying $5 billion a year for World War II. We’re still paying off beneficiaries for the Civil and Spanish-American Wars!

The U.S. accounts for less than 5% of the world’s population. We account for 37% of military spending worldwide, equal to the next seven countries (China, Saudi Arabia, Russia, the United Kingdom, India, France, Japan) combined. (And the U.S. sells a lot of hardware to most of those countries.)

Russia spends roughly a tenth as much on defense as the U.S. And they have a lot more (and twice as much territory) to defend against: NATO/American missiles to their west in Europe, a southern border full of radical Islamists in unstable countries like Kyrgyzstan and Uzbekistan, Afghanistan a stone’s throw away, historical regional superpower rival China next door. Despite its relatively small defense budget, Russia somehow manages to soldier on.

No matter how you look at it, America’s military budget is due for a haircut. If it were up to me, I’d scale quickly down to the Russian level, pro rata for square mileage — lob 95% of this bloated $600 billion a year monstrosity right off the top. But even a less radical budget cutter could do some good. A 10% cut — $60 billion a year — would buy universal pre-school or allow half of America’s four-year college and university students to have free tuition.

Insanely, we’re going the opposite direction.

President Trump wants to increase military spending by $54 billion — roughly 10% — per year.

Republican hypocrisy is brazen and obvious. Most are channeling Dick Cheney’s “deficits don’t matter” to justify huge tax cuts to rich individuals and big business. “I’m not the first to observe that a Republican Congress only cares about the deficit when a Democrat is in the White House,” the economist Alan Krueger says. But even the most strident deficit hawks, though uncomfortable with the tax cuts, have no problem whatsoever with Trump’s proposed hike in military spending.

“Any time we spend more money — even if it’s for something that we need — we need to cut spending in a corresponding aspect to the budget,” says Rand Paul. Slashing other, more needed programs — which is pretty much anything other than the military — is what passes for sanity in the Republican Party.

No one is proposing zero increase, much less a cut.

If anything, the Democrats are even worse. Democrats have promised a fierce Resistance to Trump and his works. But their oft-stated resolve is noticeably absent when it comes to He-Who-Must-Be-Impeached’s lust to jack up a crazy-ass defense budget that doesn’t have much of a justification to exist at all.

“This budget shifts the burden off of the wealthy and special interests and puts it squarely on the backs of the middle class and those struggling to get there … Democrats in Congress will emphatically oppose these cuts and urge our Republican colleagues to reject them as well,” Senate Minority Leader Chuck Schumer said.

Notice what’s missing? Like other Democratic leaders, Schumer’s beef is with Trump’s proposed cuts to the arts, EPA and other domestic spending, and the tax cuts. He doesn’t say boo about the defense increase.

As usual, Bernie Sanders was better than other Democrats. But even he didn’t explicitly reject the idea of a military increase on its face.

As we move past Memorial Day — the holiday when we remember the war dead, the vast majority who died not to defend America but to oppress people in other countries who never posed a threat to the United States — we should reconsider the assumption that all military spending is good spending.

(Ted Rall (Twitter: @tedrall) is author of “Trump: A Graphic Biography,” an examination of the life of the Republican presidential nominee in comics form. You can support Ted’s hard-hitting political cartoons and columns and see his work first by sponsoring his work on Patreon.)

SYNDICATED COLUMN: Yes, I Can

Straight Talk on Balancing the Budget

The federal budget deficit is like the weather. Everybody talks about it; except for Bill Clinton, no one ever does anything about it.

President Obama’s bipartisan Fiscal Debt Commission has released a draft report that starts out with a big problem: even talking about reducing spending is insane when you’re in the midst of a Depression. The real unemployment is over 20 percent. Creating jobs ought to be the feds’ top—perhaps sole—priority.

Let the insanity commence.

Triumphant Republicans say they want to balance the budget. So does Obama. Are they serious? Of course not.

Still, theoretical budget-balancing exercises help enlighten us about where our taxdollars really go. So let’s roll up our sleeves and start some back-of-the-envelope slashing.

The 2010 federal budget shows $3.6 trillion in spending and $2.4 trillion in revenues. Net deficit: $1.2 trillion. It’s a doozy, too. It nearly 13 percent of GDP. It’s the highest since 1943, during World War II.

The goal, then, is to close a $1.2 trillion budget gap. Can we find at least $1.2 trillion in budget cuts? News flash: getting rid of the National Endowment for the Arts ($161 million in 2010, or about 0.01 percent of the deficit), ain’t gonna do the trick.

Any serious budget cutter has to start with defense. The reason is simple: it accounts for 54 percent of discretionary (i.e., optional) federal spending. It’s the biggest piece of the pie by far.

(Mainstream news reports usually state that defense accounts for 20 percent of federal outlays. But they’re fudging the facts in order to pretty up the military-industrial complex. For example, they include budget items like Social Security that no one can do anything about—they’re in a trust fund.)

Of that 54 percent, 18 percent is debt service on old wars. There’s nothing we can do about that—though that number should probably give us pause the next time a president wants to invade Panama or Grenada.

Anyway, that leaves 36 percent, or $1.3 trillion to play with. $200 billion a year goes to Afghanistan and Iraq.

Let’s pull out. We’re losing anyway.

New Deficit: $1.0 trillion.

In 2007 Chalmers Johnson wrote a book about the staggering costs of American imperialism. “The worldwide total of U.S. military personnel in 2005, including those based domestically, was 1,840,062 supported by an additional 473,306 Defense Department civil service employees and 203,328 local hires,” he wrote. “Its overseas bases, according to the Pentagon, contained 32,327 barracks, hangars, hospitals, and other buildings, which it owns, and 16,527 more that it leased. The size of these holdings was recorded in the inventory as covering 687,347 acres overseas and 29,819,492 acres worldwide, making the Pentagon easily one of the world’s largest landlords.”

We’re broke. It’s time to bring those 2.3 million men and women home. At an average cost of $140,000 per employee—crazy but true—we could save $322 billion annually.

New Deficit: $676 billion.

After Defense, the other big costs are Social Security, Medicare and Medicaid.

The obvious place to start slashing is wealthy recipients. Why should Bill Gates, worth $58 billion, get Social Security or Medicare benefits? Dean Baker sums up the traditional liberal argument in favor of giving tax money to people who don’t need it: “Social Security enjoys enormous bipartisan support because all workers pay into it and expect to benefit from it in retirement. Taking away the benefits that better-off workers earned would undoubtedly undermine their support for the program. This could set up a situation in which the program could be more easily attacked in the future.”

Yeah, well, whatever. We. Are. Broke. “Means testing”—for example, eliminating benefits for the approximately one percent of families over age 65 who earn over $100,000 a year—could save $150 billion a year.

New deficit: $526 billion.

Now let’s talk about the other side of the equation: income. How can the U.S. government scare up some extra cash?

Allowing the Bush tax cuts for the richest three percent of Americans to expire on schedule would bring in $70 billion a year. Seems like a no-brainer: anyone earning over $250,000 a year is doing awesome. Moreover, if Democrats don’t insist on the expiration of at least some of those “temporary” tax cuts, what’s the point of the deal they cut with the GOP back in 2001?

New deficit: $456 billion.

When it comes to revenues, you have to go where the money is: the wealthy. The rich have gotten richer, which is a big part of the reason we’re in a Depression again. They’re hogging all the goodies. The rest of us can’t spend.

Despite the miserable economy, there are still 2 million American households earning a whopping $250,000 or more per year. (Their average income is $435,000.) If we were to increase these super-rich Americans’ marginal income tax rate from 35 to 50 percent—the same it was during the early 1980s under Reagan—we’d bring in an extra $131 billion a year. If we raised it back to 91 percent—the top rate during the boom years between 1950 to 1963—the Treasury would collect $487 billion.

Budget SURPLUS: $31 billion.

And we haven’t started on corporate taxes.

(Ted Rall is the author of “The Anti-American Manifesto.” His website is tedrall.com.)

COPYRIGHT 2010 TED RALL