Voters Turn Against Pols’ Follow-the-Polls Strategy

In order to be a good leader, Disraeli said, “I must follow the people.”

Aided and abetted by toe-sucking pollster Dick Morris, Bill Clinton finessed the art of leading from the rear, relying on Morris’ tracking surveys to help him decide everything from whether to bomb Serbia to when and if to take a vacation.

By definition, however, leaders point where their followers should go. Americans haven’t seen much real leadership on the federal level since Reagan. Where there’s been progress, such as on gay rights, the President only stepped forward after public opinion had shifted enough to make it safe.

For the first time in 30 years, Dick Morris’ follow-the-voters strategy appears to be running out of steam. This year, the electorate seems to be hungering for presidents in the mold of TR, FDR and LBJ—old-school leaders who painted ambitious visions of where America could go and why it should, who took political gambles that the people might not be ready for what they had in mind, who anticipated crises and challenges before anyone else, and explained why we had to act sooner rather than later.

The craving for leadership is evident in the polls. Though personally popular and enjoying the advantages of incumbency, President Obama is running neck and neck against Mitt Romney, an awkward candidate from a minority religion who has trouble connecting with, and is seen as out of touch by, ordinary voters.

Democrats must be worried. Historically, Republican presidential nominees typically gain on Democrats throughout the fall. At this point in the game, Democrats need a substantial lead in order to emerge victorious in November.

What’s going wrong? Mainly, it’s the economy. It sucks. Still. Democrats say the President inherited the meltdown from Bush. But Americans blame Obama.

“The nation’s painfully slow pace of growth is now the primary threat to Mr. Obama’s bid for a second term, and some economists and political allies say the cautious response to the housing crisis was the administration’s most significant mistake,” reports The New York Times. Obama’s big screw-up: “He tried to finesse the cleanup of the housing crash, rejecting unpopular proposals for a broad bailout of homeowners facing foreclosure in favor of a limited aid program—and a bet that a recovering economy would take care of the rest.”

Recovery? What recovery?

The depressed housing market, coupled with the reduced purchasing power of tens of millions of Americans who lost their homes to eviction and/or foreclosure, makes recovery unlikely to impossible for the foreseeable future.

Many people, including yours truly, warned that the millions of Americans who were evicted under foreclosure, many of them illegally, were more “too big to fail” than Citigroup. Some, like former Congressman Jim Marshall (D-GA), voted for TARP, but urged the Obama Administration to condition the bailout on forcing the banks to refinance mortgages and write down principal to reflect the new reality of lower housing prices. “There was another way to deal with this, and that is what I supported: forcing the banks to deal with this. It would have been better for the economy and lots of different neighborhoods and people owning houses in those neighborhoods,” Marshall says.

Voters aren’t mad at Obama for not being clairvoyant. They’re pissed off because he ignored people who were smart and prescient in favor of those who were clueless and self-interested, like Tim Geitner. He may be about to pay a price for that terrible decision.

Tens of millions of Americans already have.

Speaking of leadership—the art of seeing what comes next and doing something about it—what looming problems are the political class ignoring today?

It’s too late to stop the 2008-to-2012 economic meltdown. But it’s still possible for Obama (or, theoretically, Romney) to get ahead of the economy—permanent unemployment benefits, anybody?—and other pressing issues.

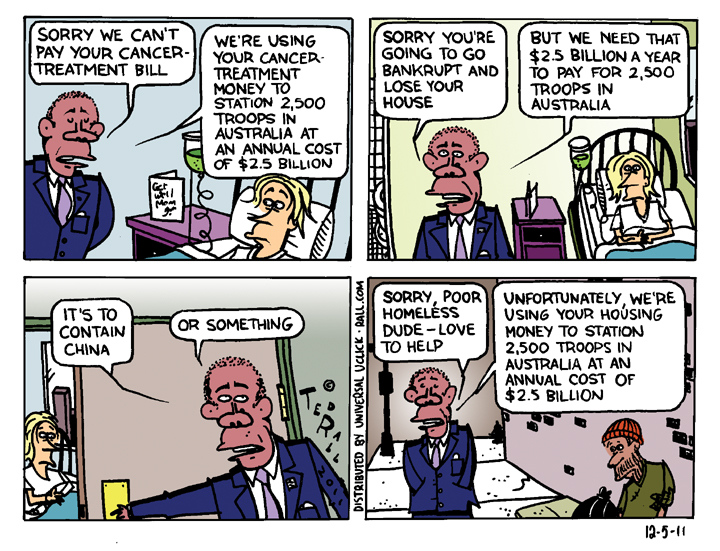

Australia, for example, is taking the climate change crisis seriously.

Americans want leaders who point the way forward, to anticipate monsters we can’t yet imagine. For example, there is a huge looming crisis: pensions. In 10 to 15 years, Generation Xers will hit traditional retirement age. How will they eat?

Close to none have traditional defined-benefit pension plans. Gen Xers, who earn far less than the Baby Boomers at the same age, have been shunted into 401(k)s, which turned out to be a total ripoff: the average rate of return between 1999 and 2010 was 0.3 percent.

Total.

And much of that was withdrawn—under penalty—to subsist after layoffs.

“[Gen Xers] have no savings, and what they had was devastated by two market crashes,” said Andrew Eschtruth of the Center for Retirement Research. “They never got off the ground.”

If you’re 45 years old now and just beginning to save for retirement, financial planners say you should save 41 percent of your income annually (if you haven’t gotten laid off again). As if. Half of Gen Xers live hand to mouth; the rest save a piddling six percent a year.

The Gen X retirement crisis represents 46 million people waiting for a savior—and 46 million potential votes.

Attention Mssrs. Obama, Romney and anyone else presenting yourself as a would-be leader: Don’t just read the polls. Don’t follow us. Show that you care about, and have a credible plan to confront, the problems of the future. If you do that—and we’re not holding our breaths—we’ll pay attention to you.

(Ted Rall’s new book is “The Book of Obama: How We Went From Hope and Change to the Age of Revolt.” His website is tedrall.com. This column originally appeared at NBCNews.com’s Lean Forward blog.)

COPYRIGHT 2012 TED RALL